income tax rates 2022 australia

2024 Tax Tables 2023 Tax Tables 2022 Tax Tables 2021 Tax Tables 2020 Tax Tables 2019 Tax Tables 2018 Tax Tables 2017 Tax Tables 2016 Tax Tables 2015 Tax Tables 2014 Tax Tables. Starting in 2022 the earned income tax credit is not allowed if the aggregate amount of investment income is more than 10300.

What Are The Current Marginal Tax Rates Canstar

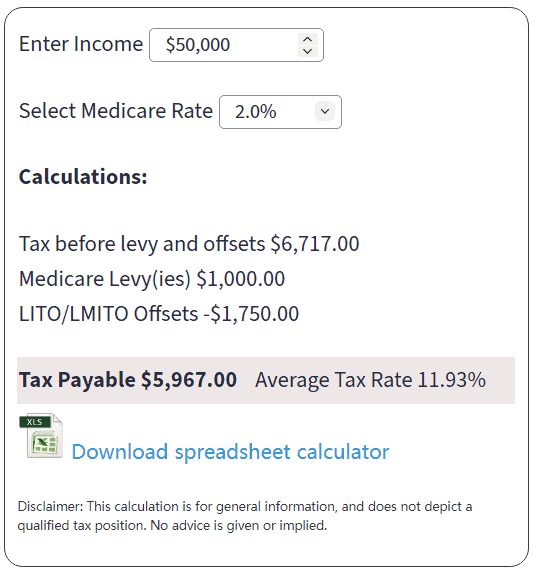

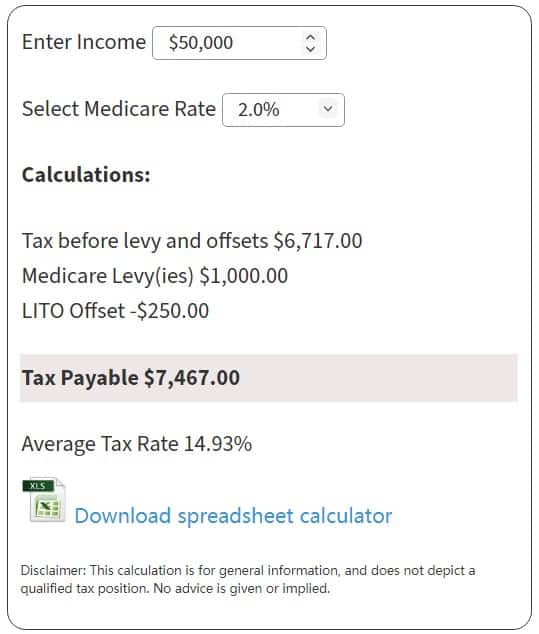

ICalculators Australia Tax Calculator.

. The highest tax rate individuals pay differs significantly across Europe with Denmark 559 percent France 554 percent and Austria 55 percent having the highest top statutory personal income tax rates. The following historical personal income tax rates and brackets since 1983 are sourced from the ATO. 1971-1974 observing 1780 families testing guarantee levels from 075 to 100 and tax rates from 04 to 06.

Countries with similar tax brackets include Australia with a maximum tax bracket of. A subsequent Budget 2019 measure further expanded the 19 income ceiling to 45000 from 1 July 2022. The last experiment was the biggest one conducted in Seattle-Denver 1971-1982 and containing three lengths of treatments ie3510 years and testing guarantee levels from 095 to 140.

What income tax is payable based on 2020-2021 ATO tax rates. Calculate salary for non-residents. The first income tax in Australia was imposed in 1884 by South Australia with a general tax on income.

The legislation is hereThere were further amendments in 2019. Salary Calculator Australia is updated with 2021-2022 ATO tax rates but you can also calculate taxes for the previous year ie. Australia has a progressive tax system which means that the higher your income the more tax you pay.

ICalculators Australia Tax Calculator. Updated with 2021-2022 ATO Tax rates. 2022 Tax Rates for.

For salary and wage payments made on or after 1 July 2021 the new superannuation guarantee contribution rate of 10 will apply. Free tax calculator. The 2018 Budget announced a number of adjustments to the personal tax rates taking effect in the tax years from 1 July 2018 through to 1 July 2024.

2019-2020 State Income Tax Rates Sales Tax Rates and Tax Laws. Income Tax Rates in 2024. 2024 Tax Tables 2023 Tax Tables 2022 Tax Tables 2021 Tax Tables 2020 Tax Tables 2019 Tax Tables 2018 Tax Tables 2017 Tax Tables 2016 Tax Tables 2015 Tax Tables 2014 Tax Tables.

In economics a negative income tax NIT. Australia has a progressive tax system which means that the higher your income the more tax you pay. Italy Income Tax Brackets Tax Bracket yearly earnings Tax Rate 0 - 15000.

Italy Income Tax Rates for 2022. The Federal Budget on. Taxable income Low income tax.

Most countries personal income taxes have a progressive structure meaning that the tax rate paid by individuals increases as they earn higher wages. Income Tax Rates in 2023. Use this simplified income tax calculator to work out your salary after tax.

So check your payslip employer is paying you the. Updated with 202122 ATO tax rates.

Tax Rise For Low And Middle Income Workers Possible As Lmito S Fate Hangs On Federal Budget Abc News

Dutch Corporate Income Tax Rate Increase For Fy 2022 Kpmg Netherlands

Australia In The Global Economy Australian Taxation Office

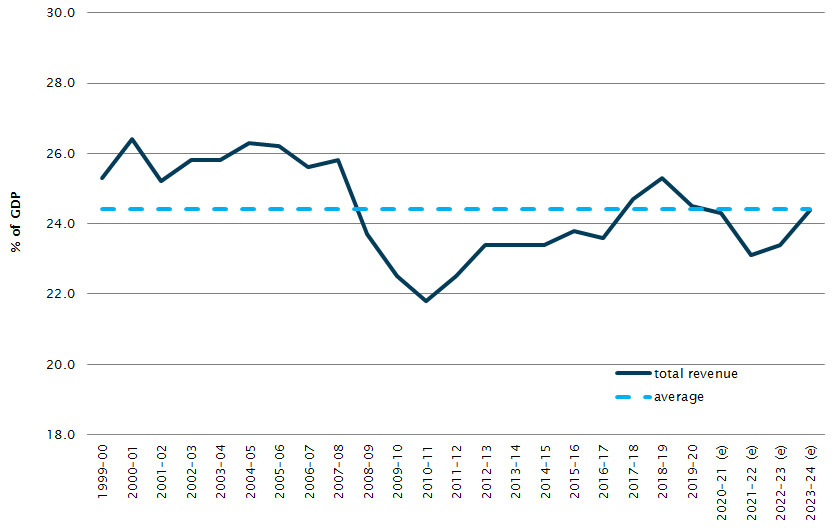

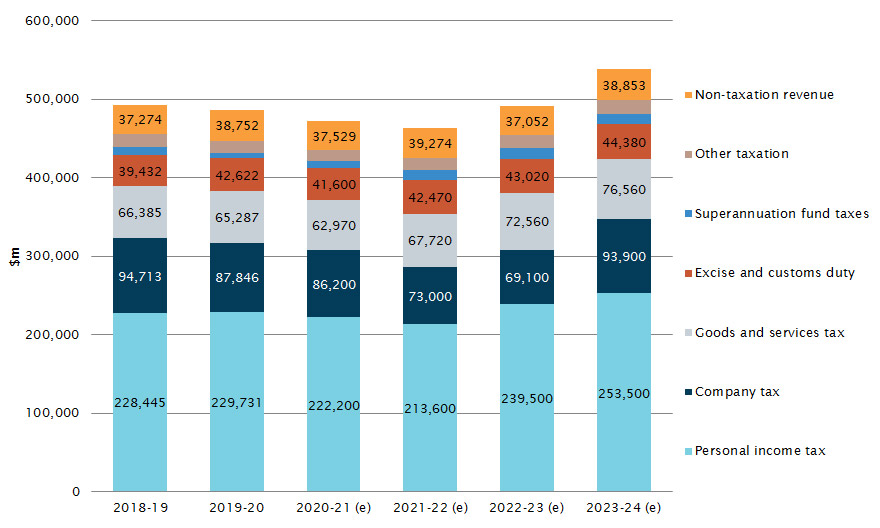

Australian Government Revenue Parliament Of Australia

Australian Government Revenue Parliament Of Australia

Australian Income Tax Brackets And Rates For 2021 And 2022

Income Tax Brackets For 2022 Are Set

Budget Overview 2022 23 Budget

Australian Tax Rates And Brackets For 2021 22 Atotaxrates Info

Tax Brackets Australia See The Individual Income Tax Tables Here

Company Tax Rates 2022 Atotaxrates Info

Australian Government Revenue Parliament Of Australia

Australian Tax Rates 2022 2023 Year Residents Atotaxrates Info

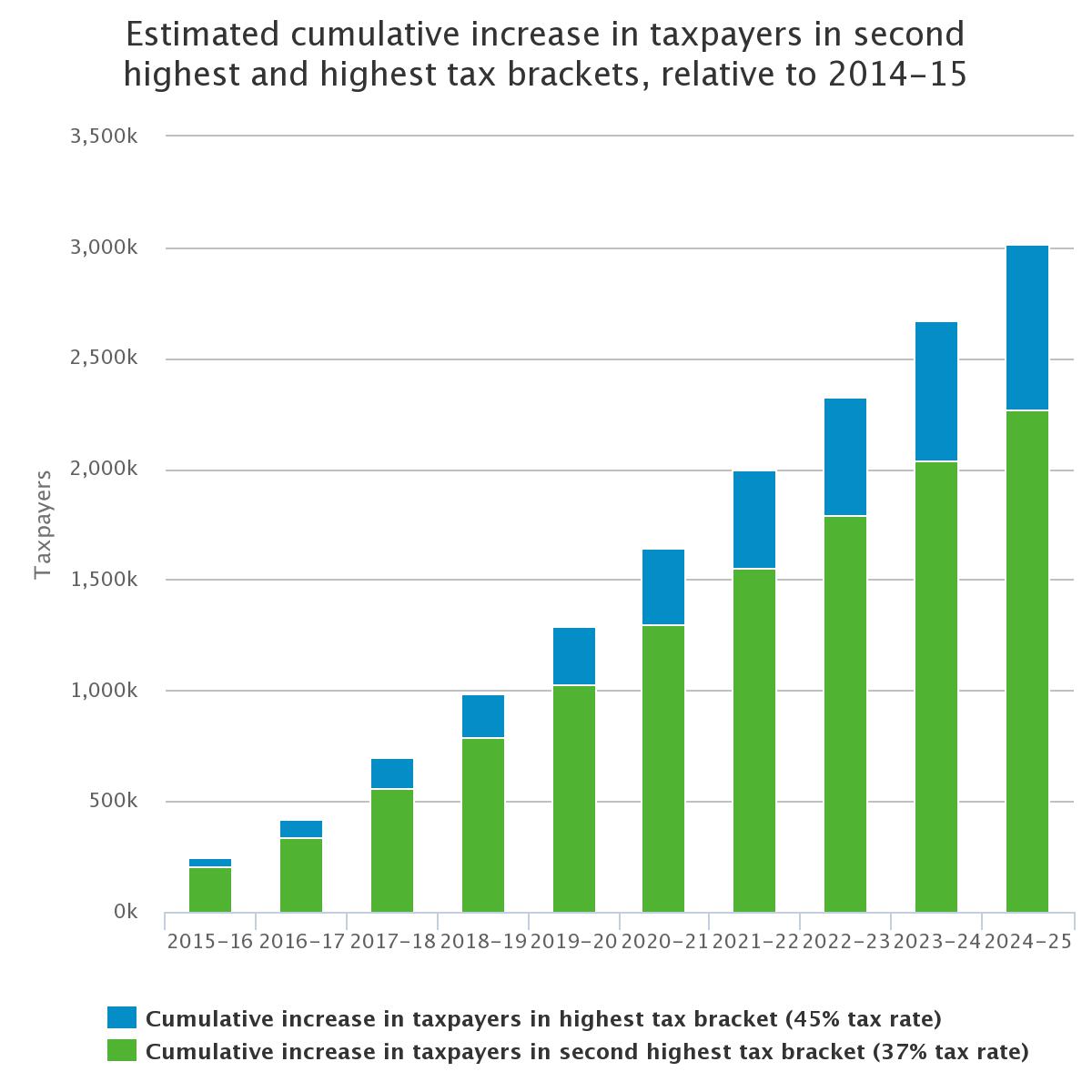

Bracket Creep And Its Fiscal Impact Parliament Of Australia

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

Stage 3 Tax Cuts Go To Wealthy Occupations Low Middle Income Earners Miss Out Report The Australia Institute

Australian Government Revenue Parliament Of Australia

Ten Reasons Why The Arguments Against Increasing Tax Are Wrong The Australia Institute